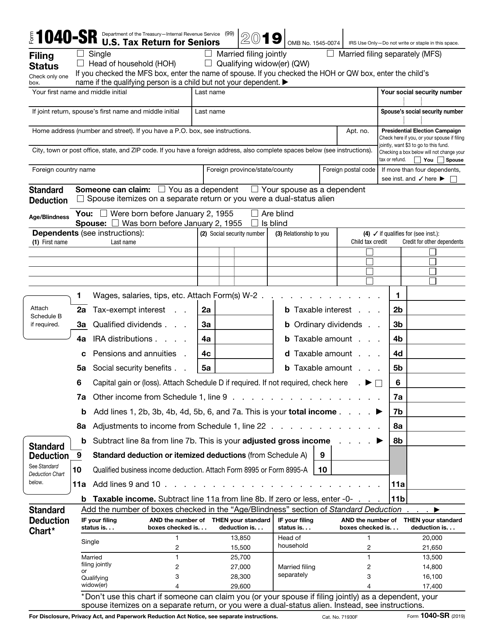

Step-by-step instructions for completing the paper form:ġa The first and last name as shown on the tax return. Joint tax filers must both be listed, in the order they appear on the tax return. PLEASE NOTE: You must enter names, Social Security numbers and street addresses exactly as they appear on the latest tax return.

Have it sent to you so that you can upload a copy of it through FAST. Because the tax transcript will not include your USC ID number, DO NOT have it sent directly to USC.Please complete all appropriate sections on the form to identify yourself, indicate the appropriate dates in Section 9, and sign the form, making sure to check the Signature check box. On the form, check Box 6a, "Return Transcript," to request the tax return transcript.PAPER: Complete an IRS Form 4506-T, available at, and submit it to the IRS as indicated on the form.If you do not have all of the above, you will need to use an IRS Form 4506-T to request a copy of your tax return transcript.

0 kommentar(er)

0 kommentar(er)